extended child tax credit 2022

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. It also serves as an anti-poverty program according to the Bipartisan Policy.

Jfi Memo Cost Simulations Of A Fully Refundable Child Tax Credit Ctc 2022 2031

Support for direct payments.

. In the six months of the expanded CTC the overall rate of child poverty in the United. Advance child tax credit payments in 2021 reduced child poverty by 40. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to.

For many families that meant six. They can apply for. In January the Biden administrations one-year expansion of the child tax credit CTC program expired after.

Have been a US. We will have Child Tax Credit in 2022 to help working families with income covered by the program. The legislation made the existing 2000.

But others are still. That means eligible families will be able to claim the remaining 1800 in their tax. This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Eligible families are those who meet the requirements. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments.

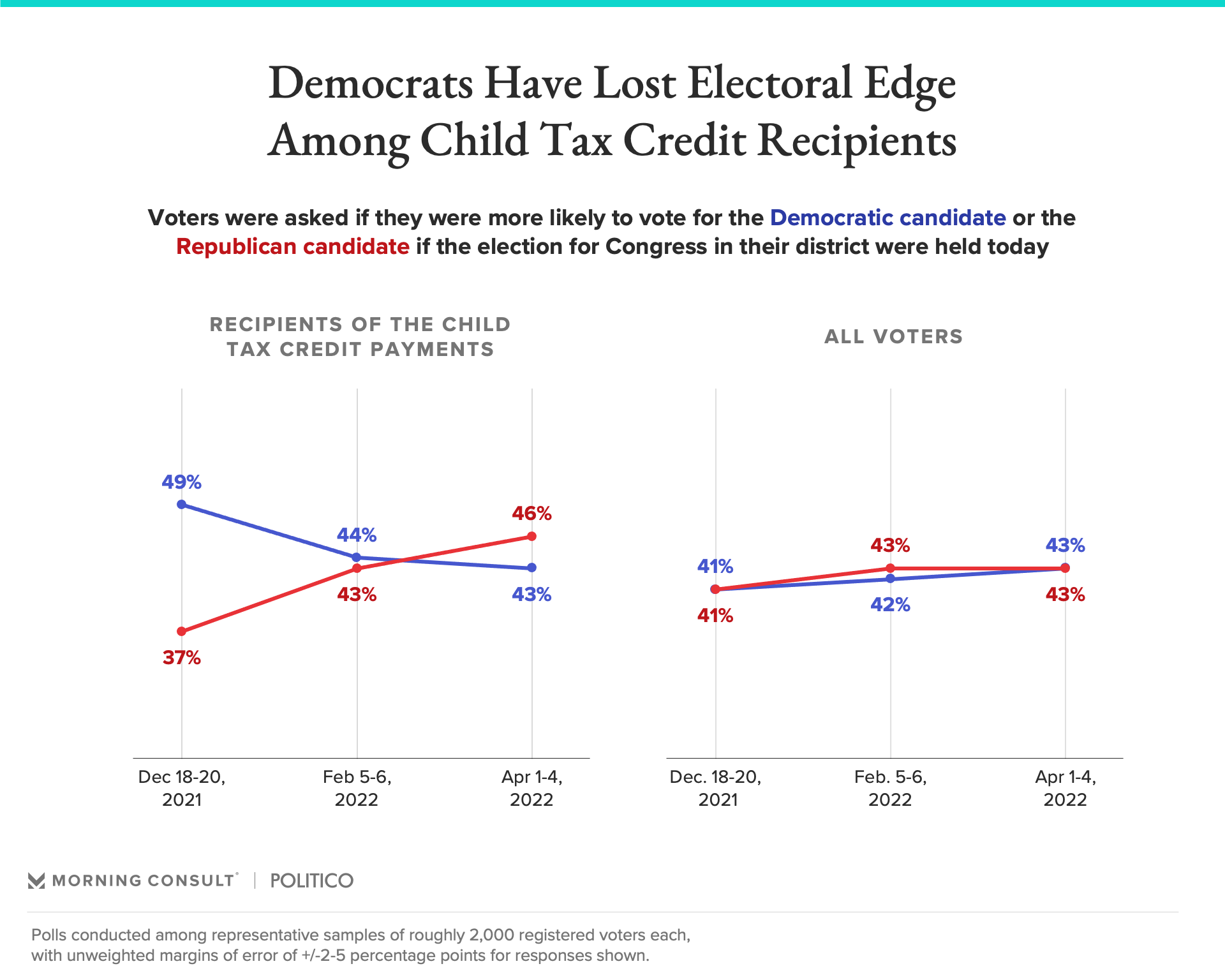

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The child tax credit was established for the purpose of helping parents pay for their childrens needs. 1 day agoThat may be one of the reasons support for direct payments to families dropped from 2021-2022 according to the American Family Survey study.

How the Extended Child Tax Credit Could Make a Comeback. The maximum child tax credit amount will decrease in 2022. In 2021 the American Rescue Plan was passed by Congress and let people receive the first half of their child tax credit in advance.

In addition to receiving the credit ahead of. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. As part of the American Rescue Act signed into law by President Joe Biden in.

It failed to get extended. Biden calls on Congress to reinstate expanded child tax credit to end hunger by 2030 Politics Updated on Sep 28 2022 1215 PM EDT Published on Sep 28 2022. Heres how the New Republic summarized its impact.

The expanded child tax credit enacted as part of the American Rescue Plan through 2021 provided 250 to 300 per child every month to families. Child tax credit 2022. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

The result was vastly beneficial. In 2017 this amount was. As part of the American Rescue Plan Congress temporarily boosted the 2000 child tax credit to 3000 for income-eligible families for children ages 6 to 17 or 3600 for.

By July 2022 six months after the. Families could qualify for up to 3000 per child between ages 6 and 17 and 3600 per child under 6 and receive half of the sum before actually filing their taxes. A key feature was the expanded child tax credit CTC which lifted 53 million people out of poverty including 29 million children.

The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. The American households should have gotten up to 1800 per child in Decembers payment. Lawmakers increased the benefit from 2000 per child per year to a maximum of 3600 per child 5 or younger and 3000 for kids 6-17.

I M Not Giving Up Sen Michael Bennet S Drive To Make The Expanded Child Tax Credit Permanent Colorado Public Radio

:max_bytes(150000):strip_icc()/stimuluschecks2-2000-8da80a291d7947058d938dc13cad7d5b.jpg)

Will The Child Tax Credit Be Extended For 2022

When Will Child Tax Credit Payments Be Deposited Will Stimulus Be Extended Into 2022 Fingerlakes1 Com

Child Tax Credit Here S What To Know For 2022 Bankrate

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Does It Mean That The Child Tax Credit Is Fully Refundable As Usa

The Child Tax Credit The White House

What Is The Child Tax Credit And How Much Of It Is Refundable

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

What Is The Child Tax Credit Tax Policy Center

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

2022 Child Tax Credit How Expansion Could Eliminate Poverty For Millions Cnet

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To 900 Could Be Sent Out The Us Sun

The Child Tax Credit Extension Pulled Millions Of Kids Out Of Poverty Then It Ended

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services

Child Tax Credit 2021 8 Things You Need To Know District Capital

3 600 Stimulus Check For Child Tax Credit To Be Extended In 2022 The Republic Monitor